529 Plan Running Low? Here’s How the Backdoor Education Tax Credit Can Help

- Devin M. Starr, CFP®

- Sep 2, 2025

- 5 min read

Key Takeaways

This fast-rising cost of college and grad school has found even high-earning households short.

The backdoor education tax credit allows affluent parents to gift appreciated assets to students who can claim education tax credits directly.

Students can offset capital gains from selling gifted assets with education tax credits like AOTC ($2,500) or LLC ($2,000).

With the cost of higher education rising faster than the rate of inflation, many families find themselves tuition-short, even after saving diligently for two decades in a tax-advantaged 529 plan. This is particularly common for families with children in the latter years of college or who decide to attend graduate school.

To raise cash, it’s tempting to sell stock from a brokerage account or to borrow from a home equity line of credit (HELOC). But selling stock may trigger capital gains taxes which adds on to the already high cost of paying for college. Granted, education tax credits can help refund a portion of your college costs, but unfortunately many successful parents find that their income is too high to qualify for those credits.

That’s when a “Backdoor” Education Tax Credit might make sense. The backdoor education tax credit is a little-known college funding strategy that allows parents to gift appreciated stock or other appreciated assets to their student -- and then have the student sell the assets quickly and pay the tuition directly with the proceeds. The rationale is that since the student is not earning a high income, they can take advantage of education tax credits directly and use them to offset the capital gains tax from raising cash for the tuition payment. The child’s capital gain amount (up to $2,500) can then be wiped out by the $2,500 American Opportunity Tax Credit. The AOTC can be taken by single taxpayers with AGI under $80,000 and married taxpayers with AGI under $185,000 assuming their student is enrolled at least half-time in a degree program and is in their first four years of higher education.

Most education tax credits are taken by parents. But they can be claimed by students who pay their own college expenses, file their own tax returns and are not claimed as dependents on anyone else’s return.

Best Candidates For Backdoor Education Tax Credit

A 529 is still one of the best ways to save for college. The backdoor education tax credit strategy is really meant for people in the following circumstances:

They have children in college.

They don’t have enough saved in a 529 to cover tuition fully and must pay out of pocket.

Their income is too high to qualify for the education tax credit on their own tax return.

They have highly appreciated stock that they want to diversify away from.

How To Execute The Backdoor Education Tax Credit

In order for your child to take full advantage of the education tax credit, he or she needs to make a tuition payment in their own name (not be claimed as a dependent on their parents’ tax return) and must have enough tax liability to be offset by the education tax credit. Since many students don’t have enough tax liability to offset the credit, we can help them generate enough taxes by gifting them highly appreciated stock and have them sell it immediately to realize the capital gains. The student can then make a tuition payment using the stock proceeds.

At Novi, we can help you facilitate this strategy by calculating how much stock you need to gift to your student to generate enough capital gains to be taxed via kiddie tax rules, which I’ll discuss in a minute.

The Education Tax Credits

The American Opportunity Tax Credit (AOTC) is a tax credit of up to $2,500 when you pay for qualifying tuition expenses. To qualify, you need to pay at least $4,000 of tuition expenses in a tax year to receive the maximum credit. Again, the credit starts to phase out at $160,000 AGI for married couples filing jointly, $80,000 single filers and the student must be in their first four years of college.

However, after the first four years of college, there is another education credit called the Lifetime Learning Credit (LLC), which has helped many families with students in graduate school or taking an extra year of undergrad.

Lifetime Learning Credit

If you are not eligible for the (AOTC) because your child is beyond their first four years of higher education or not enrolled at last half-time in a degree program, the Lifetime Learning Credit (LLC) may help you instead. The LLC is a tax credit for eligible tuition and expenses at a qualified educational institution. It's worth up to 20% of the first $10,000 of eligible expenses – or $2,000 – per return, not per student. It's not as valuable as the AOTC, which can be worth up to $2,500 per student in the first four years of college. But the requirements for the lifetime learning credit are much less restrictive.

You can claim the lifetime learning credit for undergraduate or graduate school expenses beyond the first four years, and you can also claim it for continuing education or professional development classes you take to improve your job skills. You can claim a partial credit if your MAGI was between $80,000 and $90,000 if you file as single or head of household, or between $160,000 and $180,000 if you're married and filing jointly.

Kiddie Tax

Kiddie tax rules prevent parents from gifting stock to their children to have their low-income children realize the capital gains at the 0% bracket. The kiddie tax rules tax unearned income (investment income + capital gains) of dependent children at the parent’s tax rate. Specifically, the kiddie tax breakdown is as follows:

The first $1,350 of unearned income is taxed at the child’s standard deduction (no tax).

The next $1,350 is taxed at the child’s tax rate.

Anything above $2,700 is taxed at the parent’s tax rate.

For example, parents in the 15% capital gains bracket with a child showing no income would have the child’s realized capital gains taxed as follows:

First $1,350 of realized gains (no tax)

Second $1,350 of realized gains (no tax because the child is in the 0% capital gain bracket).

Any capital gains above $2,700 would be taxed at the parents’ capital gain rate of 15%.

Real-World Example

We recently helped a couple with highly appreciated Apple (AAPL) stock fund a portion of their kid’s college by using the backdoor education tax credit. This allowed them to diversify away from some of their Apple stock while reducing taxes needed to raise cash for the tuition payment. Our client was over the $160,000 adjusted gross income limit to claim the credit themselves. So, it was more efficient to let their child sell the stock for tuition need and pay tax at their reduced capital gains tax rate (see below):

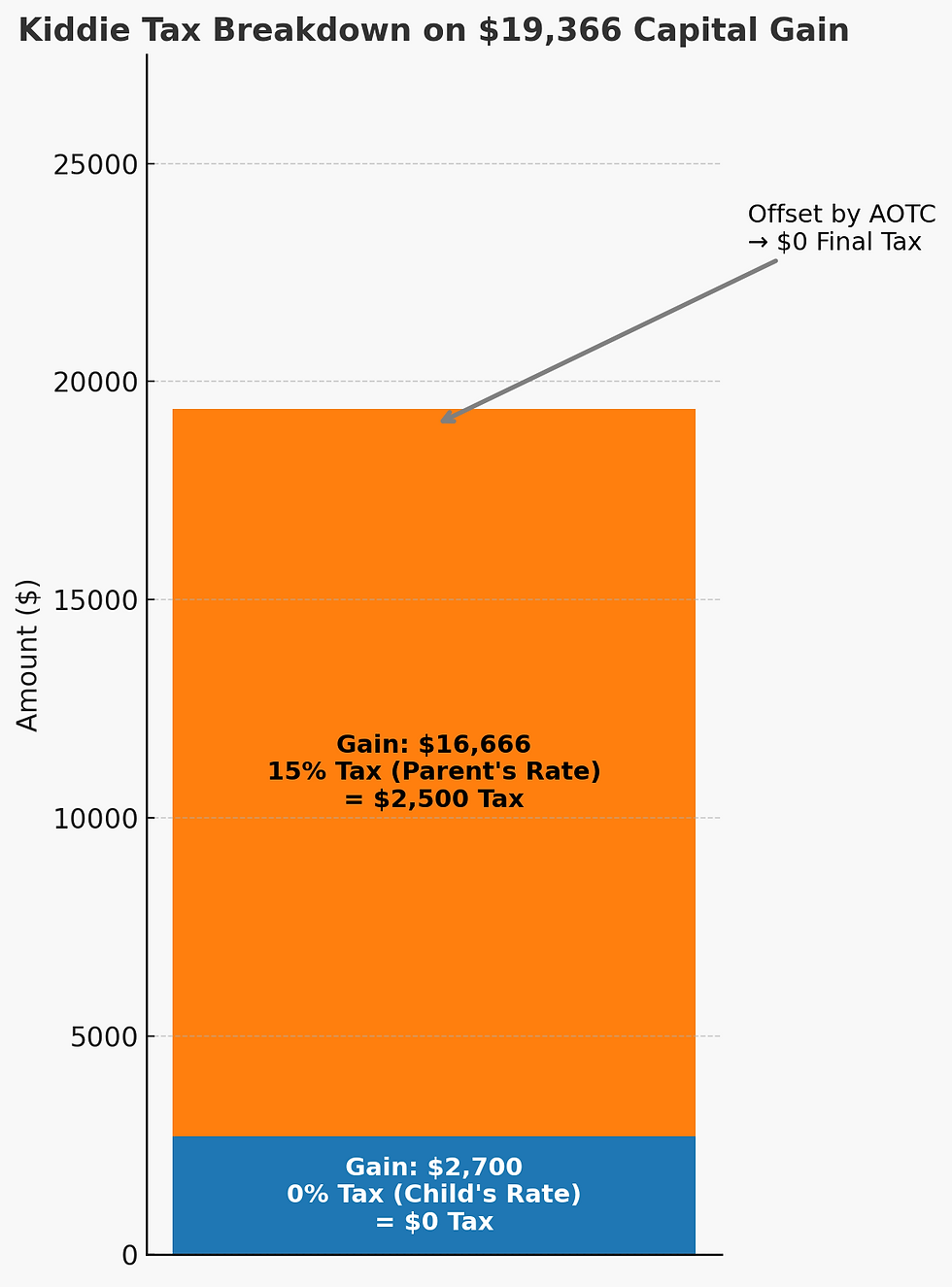

Since 75% of the couple’s Apple position was unrealized gain, they gifted $25,822 of Apple stock to the child’s brokerage account. Then their student immediately sold the stock, producing a $19,366 capital gain (75% of $25,822) and used the proceeds to make the next tuition payment. The $19,366 gain created a tax liability of $2,500 for the child based on the following breakdown as per IRS rules:

This first $2,700 was taxed at 0% since the student had very low income.

The remaining $16,666 was taxed at the 15% long-term capital gains rate, resulting in a $2,500 gains tax. The gains tax was then wiped out by the $2,500 AOTC when claimed on the child’s return.

Without using this strategy, the couple would have paid 15% tax on the $19,366 gain or $2,904.

The backdoor funding strategy works the same way as described at the beginning of this post, but you would want to gift an amount to your student so that their capital gain tax would amount to no more than $2,000 rather than $2,500, so it can be completely wiped out by the LLC. For instance, if the parents gifted $16,033:

First $1,350 of realized gains (no tax)

Second $1,350 of realized gains (no tax because the child is in the 0% capital gain bracket).

The remaining $13,333 would be taxed at the parents’ capital gain rate of 15% (i.e., $2,000).

Conclusion

If you or someone close to you has concerns about funding higher education for your kids or grandkids, please don’t hesitate to reach out. I’m happy to help.

Devin Starr, CFP® Associate Wealth Advisor at Novi Wealth Partners.