Back to Basics: Diversification and Time in the Market

- Robert Dunn, CFP®

- Dec 13, 2023

- 4 min read

Key Takeaways

Today’s temptingly high rates on CDs and money markets are not likely to last.

Research shows bad timing costs fund investors a substantial chunk of their returns.

Disciplined investors have better outcomes through market cycles because they have a well-diversified portfolio and don’t chase one hot sector after the other.

Lately, a lot of people are flocking to CDs and other short-term cash like investments. For the first time in over a decade, CDs, money markets, and short-term Treasuries are paying investors something meaningful (4% to 5% and more). It’s tempting for some to add a generous amount to your investments of these "risk-free" returns and not have to worry about the stock and bond markets. Just remember we’re talking about short-term instruments and these newly generous rates are just that -- short-term. When the Fed’s rate hiking cycle is over, you’ll be back to chasing higher returns again and you’ll need a more diversified portfolio to reach your long-term objectives. Research shows again and again that you can’t build your long-term financial plan around a single asset class. Things change all the time—you just never know when. Despite significant evidence to the contrary, we keep telling ourselves we can win by jumping around to the top performing asset class. In contrast the diversified portfolio (in white below) is never at the top of or the bottom, just trudging along providing an average return.

Disciplined investors do well in all economic and market climates because they have well-diversified portfolios and don’t chase one hot sector after the other. As the chart above shows, the top-performing asset classes in one year are very often a laggard the next year, while the diversified portfolio stays near the center.

Short-Term Assets Will Not Get You To Your Long-Term Goals

As the old saying goes: “Past performance does not guarantee future returns.” Study after study shows that when you combine asset classes you improve the consistency of outcomes. If you’re looking for a decent return and trying to avoid shocks in the market, your best bet is to have more asset classes at your disposal. Again, you never know which one will outperform and which one will underperform. That’s why so many people are lost right now. They’re using short-term assets such as cash, 6- to 12-month CDs, etc. to meet their long-term goals. That’s not a prudent way to invest.

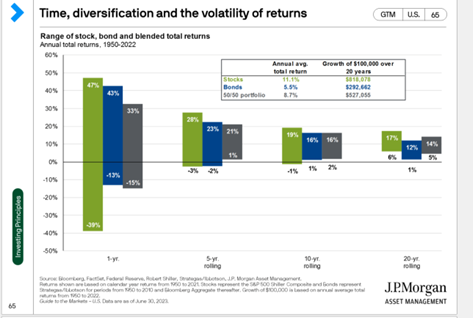

If you’re looking at the stock market all day long, you're going to drive yourself crazy with all the ups and downs. Even if you’re just looking at year-over-year returns you’ll see some fairly wild swings from one year to the next (see 1-year column in the chart below). But as the chart below also shows, the longer you stay invested, the more consistent your returns are likely to be and the narrower the volatility band over 5-, 10- and 20-year rolling periods.

Disciplined investors always do well in the long term because they stick to their plans. They don’t let their emotions get the better of them and they don’t try to get into and out of the market whenever things get stressful and/or they get frightened by the headlines. As this Morningstar study shows, bad timing costs many investors one-fifth of their fund's returns. As demonstrated in the chart, the best-performing assets typically underperform the next period after being on the top. There’s no way to have certainty of the investment return for any asset class/investment for the next year. As much as the so-called experts want you to believe they can predict what’s going to happen next in the market, there’s no predictive quality to it.

Here’s a recent example of what I mean.

Wharton Business School professor, Jeremy Siegel predicted the stock market is headed to new all-time highs thanks to a strong economy and resilient corporate earnings. "This is such a strong market," the top economist said in a CNBC interview on Friday. "Lower inflation and a stronger economy and good guidance and good profits, what's to stop this market now?" This proclamation came just six weeks after Siegel proclaimed: “The stock rally will end soon, recession will hit, and the Fed won't hike interest rates again.” If you’re feeling confused, you’re not alone.

On the same day that Siegel predicted the markets were headed for new all-time highs, former Merrill Lynch chief economist David Rosenberg told Business Insider that the Dow's hot streak is bad news for stocks, and a recession may be underway. Rosenberg warned investors not to be seduced into thinking we’ll avoid a recession just because inflation has slowed dramatically over the last 12 months thus, stoking hopes the Fed will halt its interest rate hiking campaign.

Falling back on history, Rosenberg reminded us that inflation fell sharply during the 2000 dot-com era, as well as during the 2008-09 financial crisis, and the early 1980s downturn. And the S&P 500 tanked 26%, 30%, and 8%, respectively during each of those periods.

Even more chilling, Rosenberg reminded us that for the first time since January 1987, the Dow Jones Industrial Average closed in the green for 13 straight sessions before snapping its winning streak a few weeks ago. Back in 1987, stocks were up 28% as we headed into August. Two months later, they melted down 22% in a single day (Black Monday, October 19, 1987). As with the other aforementioned rallies fueled by irrational exuberance, Rosenberg thinks today’s stock values are too frothy and called it a “FOMO-based rally.” So, who’s right? Siegel and the Bulls or Rosenberg and the Bears?

For most of you reading this post, it shouldn’t matter who is right. Changes to your portfolio should not be dictated by headlines or predictions. Smart, well-connected, and well-respected economists like Siegel and Rosenberg are looking at the same news and data as everyone else -- and they come to completely different conclusions. Again, nobody knows for sure. That’s why it’s helpful to have an objective advisor who can keep you grounded and put a long-term plan together for you. Doing so will give you the peace of mind knowing you will always be on track to reach your goals, no matter what the markets, economy, or geopolitics throw your way.

With the NFL season in full swing, I’m reminded of this great quote from Troy Aikman, Hall of Fame quarterback and broadcaster: “Things are never as good or as bad as you think they are.”

ROBERT B. DUNN, CFP® is the President and Managing Partner of Novi Wealth